It may surprise you but I am not a huge supporter of the Kansas City E-Tax which is just a modern version of highway robbery. But this post is not about my feelings about the tax, which is already well-covered on this blog. I was always interested in how it was originally sold to the prehistoric Kansascitians back in 1963, when it was only .5%. So I made a trip to the library and spend some time looking at women spinning microfilm. I bet not too many of you have seen any of these.

*note: I am not a fan of PDF files, and this is probably a rare time you’ll see them embedded on my blog, but I think they would actually make some of these newspaper clippings more readable; they are fully scrollable and magnifiable. Others were converted to image format, they are clickable and linked to better readable versions. Let me know if you encounter any problems.

This open letter to the property owners was printed in the Star/Times the day before the elections – December 16, 1963.

Preparing for the vote:

The Star reprinted this article from the Daily Oklahoman:

Promotional sample ballot:

5 important issues to consider:

E-Tax decision today:

Mayor Davis is voting for the tax on December 17, 1963.

December 18th issue: The tax passed.

January 24, 1964: Some questions clarified:

And now from the “some things never change” files:

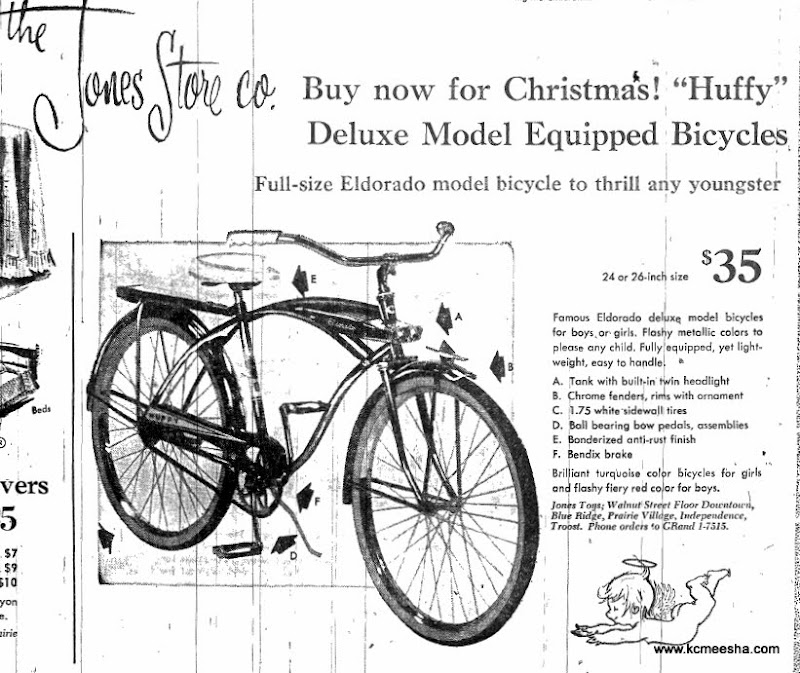

Few ads that caught my eye.

Beginnings of the real estate bubble:

Famous Pam Panties

Huffy Deluxe:

Did you know when the “Muse of Missouri” installed? Now you do:

Lastly, browsing through the old issues of the Kansas City Star/Times was somewhat of an eye-opening experience for me. I didn’t realize just how much this country was terrified of the “reds”. The USSR, Khrushchev, Red China dominated the front pages and accounted for the large part of coverage elsewhere. And for those who lament the declining journalistic standards, there were plenty of ridiculous items in the paper 50 years ago and, in hindsight, many of the serious articles were uninformed, unnecessarily alarmist, and no better than the propaganda printed in the Soviet press. No wonder the Cold War lasted this long.

Few more newspaper clippings on the subject.